New Delhi, December 29, 2025 — With the final deadline to link PAN (Permanent Account Number) with Aadhaar fast approaching — December 31, 2025 — taxpayers across India are rushing to complete the process.

The Income Tax Department has repeatedly warned that PAN cards not linked to Aadhaar will become inoperative from January 1, 2026, which can disrupt financial and tax compliance activities.

However, not everyone is required to link PAN with Aadhaar — a fact that remains confusing for many, including NRIs, senior citizens, minors, and joint account holders.

This article breaks down the exemptions, requirements, consequences and practical steps for various groups under the government’s current rules.

Why PAN–Aadhaar Linking Is Mandatory for Most

Under Section 139AA of the Income Tax Act, the government has made it compulsory for individuals who are eligible to obtain an Aadhaar number to link it with their PAN by the end of December 31, 2025. The move is aimed at curbing tax evasion, eliminating duplicate identities, and strengthening the taxpayer database.

If the PAN–Aadhaar link is not completed by the deadline, the PAN will be marked inoperative, meaning it won’t be usable for many key financial transactions and tax-filing purposes.

Who Is Exempt From Mandatory Linking

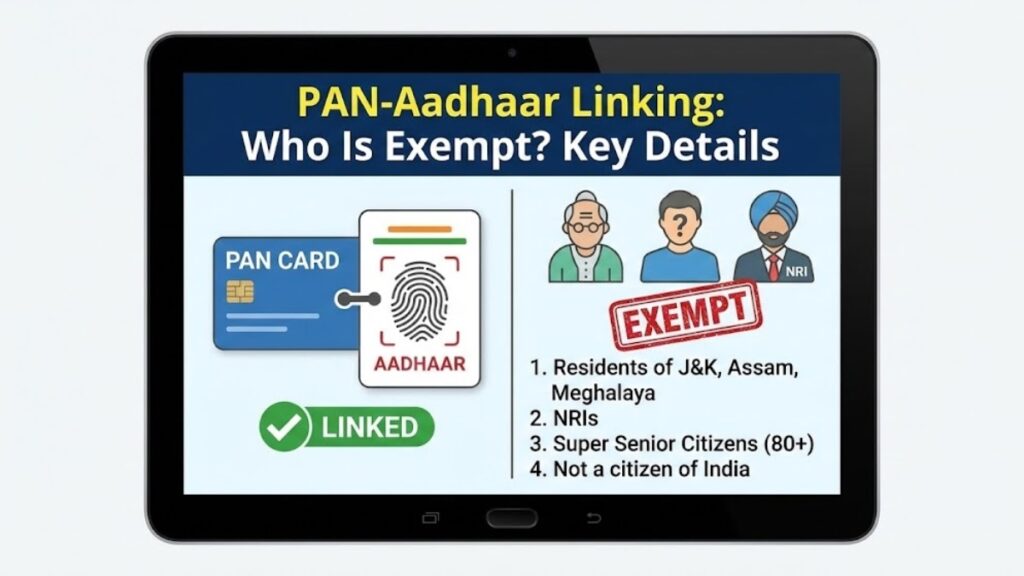

Despite the broad requirement, certain categories of people are not required to link their PAN with Aadhaar — and can continue to use their PAN even after the deadline without it becoming inoperative. The main exempt categories include:

Non-Resident Indians (NRIs)

If you are classified as an NRI under the Income Tax Act — meaning you do not meet the residency conditions (typically not in India for 182 days or more in a financial year) — you are not required to link PAN with Aadhaar. NRIs are not eligible for Aadhaar enrolment unless they return and meet the residency conditions first.

Super Senior Citizens (80 Years and Above)

Individuals who attain the age of 80 years or more at any point in the relevant financial year are exempt from the PAN–Aadhaar linking mandate, recognising the practical difficulties faced by this senior age group.

Persons Who Are Not Indian Citizens

Foreign nationals and other non-Indian citizens with a PAN issued in India do not need to link their PAN with Aadhaar. This is because Aadhaar enrolment is not available to non-residents and non-citizens.

Residents of Specific States/UTs

People residing in Assam, Meghalaya, and the Union Territory of Jammu & Kashmir are also exempt from this requirement, a provision included due to historical and administrative complexities around Aadhaar coverage in these regions.

Minors and Joint Account Holders

The News18 report clarifies that minors — individuals under 18 years of age — do not need to link PAN with Aadhaar unless they have an Aadhaar and are otherwise eligible for one. In practice, most minors are not enrolled for Aadhaar, and hence the linking requirement does not apply until they reach eligible age or obtain Aadhaar.

For joint holders, such as a joint PAN or an account with multiple holders, the linking requirement applies individually to each person’s PAN. If a joint holder falls into an exempt category (for example, an NRI co-holder or a senior citizen aged 80+), they can remain exempt. But other joint holders who do not meet the exemption conditions must link Aadhaar with their PAN to keep it operative.

Important Nuances for NRIs

While NRIs are exempt from the mandatory PAN–Aadhaar linking if they do not possess an Aadhaar, the situation becomes nuanced if an NRI does have an Aadhaar number (for example, obtained while previously resident in India). In that case, linking may become a requirement unless they update their residential status in the Income Tax database as an NRI, as official guidelines explain.

In other words:

- If an NRI doesn’t have an Aadhaar at all, they aren’t required to link PAN with Aadhaar.

- If an NRI already has Aadhaar, then they generally must link it with PAN unless they correctly reflect their non-resident status with the tax department.

What Happens If You Don’t Link and Are Not Exempt

For everyone else — i.e., resident Indians who are not exempt — failing to link PAN with Aadhaar by December 31, 2025 will render their PAN inoperative from January 1, 2026. This has significant consequences:

- Your PAN becomes unusable for filing ITRs or e-verification of returns.

- Tax refunds may be withheld or not processed.

- Higher TDS/TCS rates may apply, and credits may not reflect properly.

- Many financial transactions such as opening new bank accounts, investing in mutual funds, opening demat accounts, buying property, getting loans or insurance may be blocked.

These disruptions can affect everyday financial activities for individuals who don’t link by the deadline.

Practical Steps to Confirm Your Status

If you’re unsure whether you must link your PAN with Aadhaar — or whether you qualify for an exemption — you can take the following steps:

Check Your PAN–Aadhaar Link Status

Visit the Income Tax e-filing portal and use the “Link Aadhaar” or “Link Aadhaar Status” option by entering your PAN and Aadhaar details.

Update Residential Status

NRIs should update their residential status in the Income Tax portal to “Non-Resident” if applicable, so that the system recognises the exemption correctly.

Maintain Proof of Exemption

If you are exempt (for example, an NRI or a senior citizen aged 80+), keep relevant documents — passport, residency proof, age proof — handy for any future verification.

Summary

While PAN–Aadhaar linking is mandatory for most Indian taxpayers by December 31, 2025, several groups are exempt. These include Non-Resident Indians (NRIs) who do not possess Aadhaar, super senior citizens aged 80+, non-Indian citizens, and residents of certain northeastern regions like Assam, Meghalaya, and Jammu & Kashmir.

Minors generally aren’t required to link until they become eligible for Aadhaar, and joint account holders must consider linking requirements individually based on their own statuses. For others who do not comply, the PAN will become inoperative from January 1, 2026, leading to significant interruptions in tax filings and financial activities.