Mumbai, December 30, 2025 — Shares of Cupid Ltd, a leading Indian manufacturer of sexual and personal care products, were under the spotlight on Tuesday after the company’s board gave in-principle approval to set up a new Fast-Moving Consumer Goods (FMCG) manufacturing facility in the Kingdom of Saudi Arabia (KSA).

The development is part of Cupid’s broader strategy to expand its footprint in the Gulf Cooperation Council (GCC) region and enhance regional supply capabilities.

The approval, decided at a board meeting on December 29, 2025, comes as the company positions itself to capture growing demand for FMCG products in the Middle East, where local production can help improve speed-to-market, product availability, and competitiveness. Funding for the project is expected to come from internal accruals, with further progress subject to standard regulatory and statutory clearances.

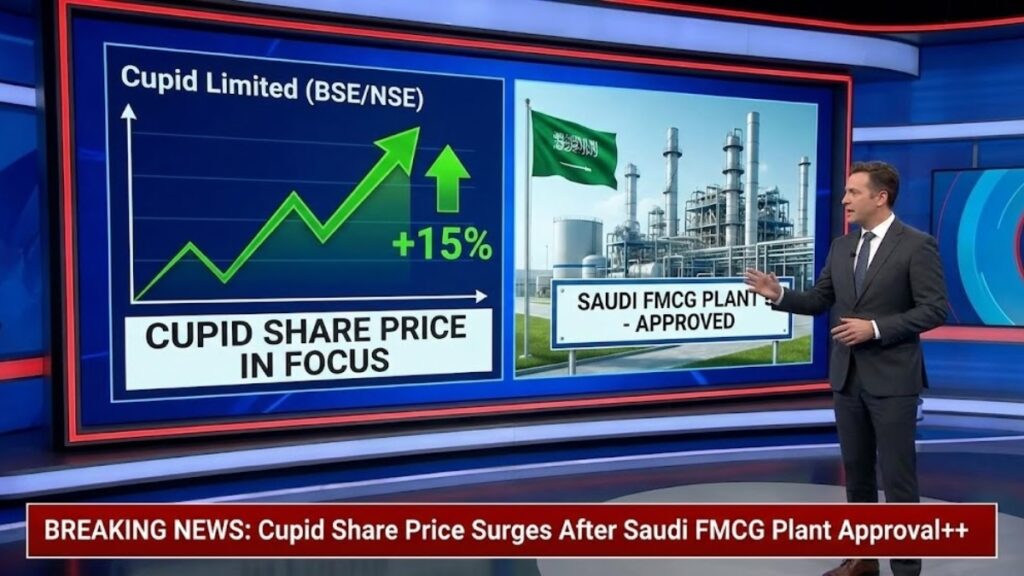

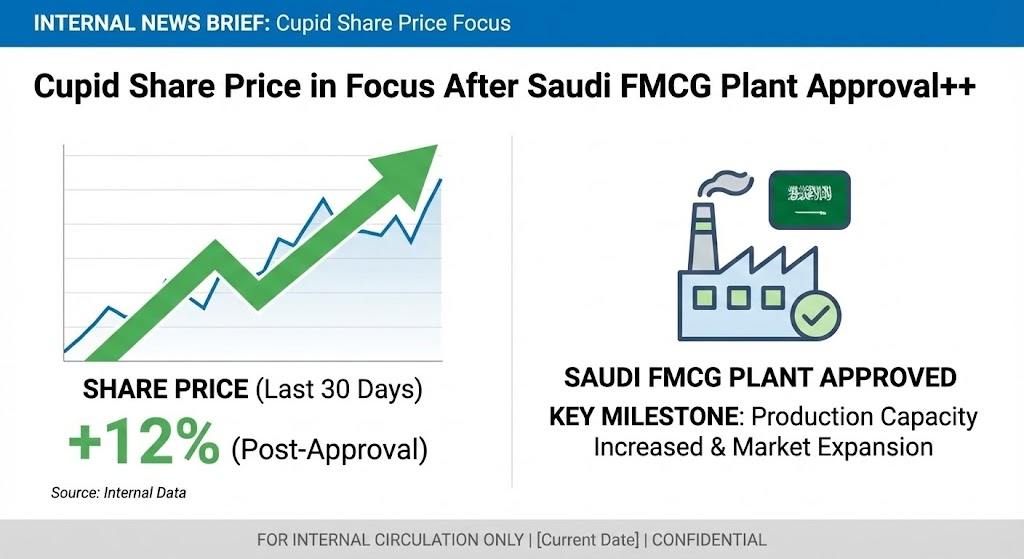

Market Reaction and Share Price Performance

Cupid’s share price reacted positively to the announcement, with the stock making gains in early trading on December 30, 2025. The share has been building momentum, reflecting broader investor interest in the company’s growth story. In recent sessions, the stock has traded near 52-week highs, signalling strong market confidence following the Saudi Arabia expansion news.

In the previous trading session, Cupid’s shares had closed around ₹486.50, and they have touched a 52-week high of roughly ₹498, staying within 1.35 percent of that level as of this week.

Over the past year, Cupid’s stock has delivered significant returns, reflecting strong performance on both financial and strategic fronts, making it a stock watched closely by market participants.

Strategic Rationale for the Saudi Facility

The move into Saudi Arabia marks a major expansion milestone for Cupid, as it would be the company’s first manufacturing unit outside India. The GCC market, with its rising consumption and logistics advantages, represents a key opportunity for companies in the FMCG space seeking global growth prospects.

Locating a facility in Saudi Arabia could benefit Cupid in several ways:

- Stronger Regional Supply Chain: Local manufacturing can reduce delivery times and import dependencies for Gulf markets, enhancing responsiveness and competitiveness.

- Improved Market Penetration: A Saudi facility could help the company deepen its presence not just in KSA but across neighbouring GCC countries, where demand for personal care and wellness products is rising.

- Cost Efficiencies: Localised production may help reduce logistics costs and tariffs, potentially improving overall profit margins.

Industry analysts note that setting up manufacturing closer to key demand centres is often a strategic priority for FMCG companies aiming to optimise distribution networks and strengthen their global presence.

Company Overview and Growth Context

Cupid Limited has been in operation since 1993 and is a leading manufacturer and exporter of male and female condoms, water-based personal lubricants, and In-Vitro Diagnostics (IVD) kits. Over time, it has diversified its product portfolio into broader personal care and FMCG categories, including deodorants, fragrances, body oils, and other wellness-oriented products.

The company has a strong global export reach, serving over 110 countries and holding pre-qualification from international bodies like WHO/UNFPA for its products. It also operates significant manufacturing capacity in India, including a major facility in Nashik, Maharashtra, and recently expanded land holdings in Palava to boost domestic production. BS Media

Financially, Cupid has shown robust growth: in the September 2025 quarter, its net sales more than doubled year-on-year to ₹84.45 crore, while net profit jumped by over 140 percent, highlighting strong operational momentum. Moneycontrol

Investor and Market Sentiment

Investor sentiment toward Cupid’s stock has been bullish in 2025, with significant price appreciation over the year. The stock has gained notable attention for its large percentage increases, driven by both fundamental performance and strategic developments such as this expansion initiative. Moneycontrol

Market analysts see the Saudi Arabia plan as a positive long-term catalyst that could help Cupid secure a stronger position in international markets and diversify its revenue streams beyond its traditional sectors.

However, as with any international expansion, risks remain, including regulatory challenges, execution timelines, and the need to adapt products and operations to local market conditions. Investors are likely to monitor the progress of regulatory approvals and the detailed business plan for the Saudi facility as the story develops.

Broader Strategic Implications

Cupid’s planned expansion into the Middle East is part of a broader shift among Indian mid-cap and small-cap companies seeking international manufacturing hubs and export-led growth opportunities. With the GCC region increasingly attractive for its logistical advantages and market potential, strategic manufacturing placements in countries like Saudi Arabia may become more common among Indian FMCG players.

This move may also inspire similar companies to consider overseas production facilities to reduce dependence on domestic markets and tap into emerging consumer demand globally.

Conclusion

The approval from Cupid Ltd’s board to set up an FMCG manufacturing facility in Saudi Arabia has placed the company’s share price in focus, reflecting investor enthusiasm for its growth strategy. By leveraging internal funds and aiming to strengthen regional supply capabilities, Cupid is positioning itself for accelerated international growth, especially in the GCC region. Moneycontrol+1

Going forward, the stock’s performance and market confidence will hinge on how smoothly the company navigates regulatory approvals and operational execution for the Saudi facility, as well as how effectively it expands its presence in overseas markets.