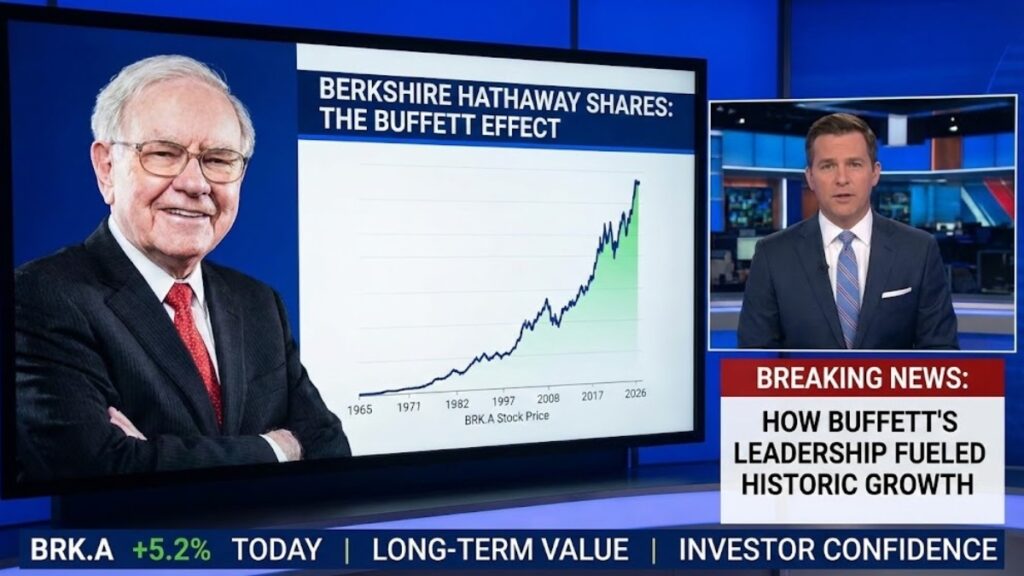

Under the guidance of Warren Buffett, Berkshire Hathaway became one of the world’s most iconic investment success stories. Beginning as a struggling textile company in the 1960s, Buffett transformed it into a diversified conglomerate worth over a trillion dollars, and its shares became massive wealth‑creators for long‑term investors.

Even as Buffett prepares to step down as CEO after more than six decades, the impact of his disciplined, value‑oriented strategy is evident in how the Berkshire stock performed over decades — rewarding shareholders far beyond typical market returns.

A Century of Share Growth: From Textile to Titan

Berkshire Hathaway’s journey from a small textile mill to a global investment powerhouse is legendary in financial circles.

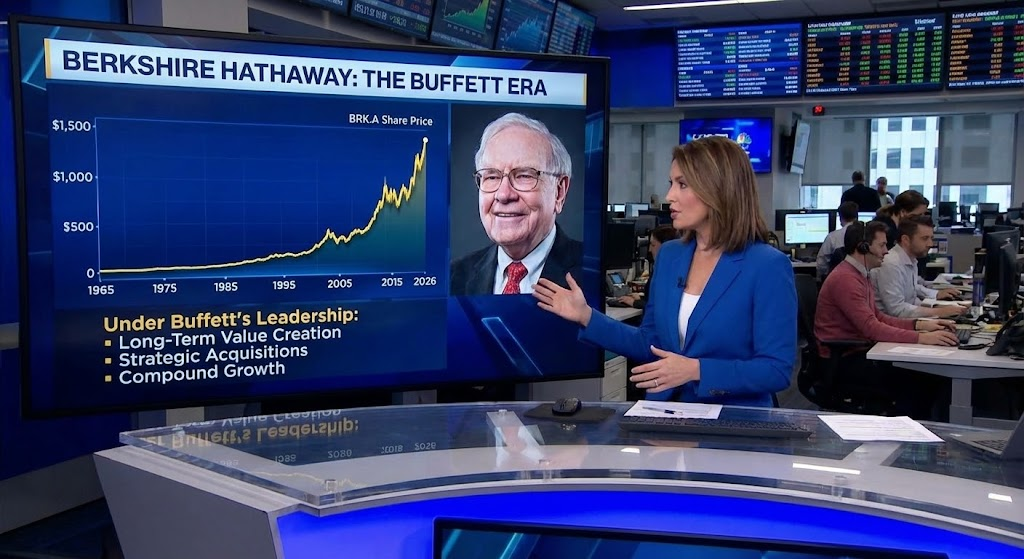

When Buffett gained control of the company in the mid‑1960s, the stock was inexpensive and unremarkable. Over the next six decades, Buffett reinvested profits wisely into insurance, railroads, utilities, manufacturing, and strategic equity stakes. This approach helped the stock grow hundreds of thousands of percent over time — far surpassing general market returns.

For example, Berkshire’s Class A shares (BRK‑A) consistently traded at extremely high prices, crossing milestones of $100,000 and $500,000 per share years ago as long‑term compounding took effect.

Why Berkshire Shares Outpaced Many Peers

Several factors contributed to the share value appreciation under Buffett:

Value Investing Philosophy

Buffett’s style — rooted in buying undervalued businesses with durable competitive advantages or “economic moats” — helped Berkshire hold strong positions through market cycles.

Diversification with Discipline

Rather than frequent trading, Buffett focused on company fundamentals. Many of Berkshire’s largest holdings included strong brands like American Express, Coca‑Cola, and Apple — businesses with resilient earnings.

Reinvestment and Compounding

Profits from wholly‑owned businesses (like GEICO and BNSF Railway) and investment gains were reinvested rather than paid out as dividends. This allowed internal capital to work harder over time.

Together, these strategies produced long‑term returns that often outpaced broad market indexes such as the S&P 500 over decades.

Recent Decade Performance and Market Context

While Berkshire’s long‑term track record remains impressive, recent years have been more mixed.

In 2024 and early 2025, Berkshire stock continued its broad gains, even hitting record levels at times — for instance rising above old highs when quarterly profits beat expectations and insurance operations improved.

However, since Buffett’s announcement of his decision to step down as CEO, the stock has experienced some volatility. Shares have at times lagged the broader market, reflecting investor uncertainty about leadership transition and the so‑called “Buffett premium” — the extra confidence investors place in the company because of Buffett’s long track record.

Despite short‑term fluctuations, the underlying business remains substantial, with Class A and Class B shares still trading above historic levels and Berkshire’s market valuation consistently near the top of global corporations.

Buffett’s Felicitous Legacy: Value Beyond Price

It’s worth noting that Berkshire Hathaway’s growth isn’t only measured in share prices. Under Buffett:

- The conglomerate achieved a market cap well above $1 trillion, placing it among the largest global companies.

- Buffett’s personal wealth tied to Berkshire shares soared into the top echelons of global fortunes, even after substantial charity contributions.

- The company maintained a reputation for financial strength, diversified earnings streams, and a cautious investment philosophy that helped weather multiple market cycles.

This approach — long‑term thinking, financial discipline, and buying quality companies at sensible prices — became known as the Buffett “genius” in investment circles.

Transition Time: What Happens Next?

As Buffett steps down as CEO, the big question on investors’ minds is whether Berkshire Hathaway can maintain its share‑value momentum.

Buffett’s successor, Greg Abel, steps into the role with strong endorsements and experience running much of Berkshire’s non‑insurance operations. Many investors remain optimistic that Abel will continue Buffett’s core principles even as the company evolves.

Some analysts view the current share price softness as a “succession discount” — a temporary dip driven by uncertainty rather than structural weakness — and see potential long‑term gains as confidence returns.

Whether shares re‑accelerate under new leadership will be an important story in 2026 and beyond.

Summary

Berkshire Hathaway’s share value soared under Warren Buffett’s leadership, growing from a modest textile company into a trillion‑dollar financial powerhouse. Buffett’s long‑term, value‑oriented investment philosophy produced returns that outpaced broad market benchmarks and rewarded patient shareholders.

Although recent leadership transition news has caused some short‑term share volatility, the company’s diversified businesses and disciplined approach continue to underpin its market position. As Buffett transitions power to Greg Abel, investors watch closely to see if the legacy of share‑value growth can continue into the next chapter.