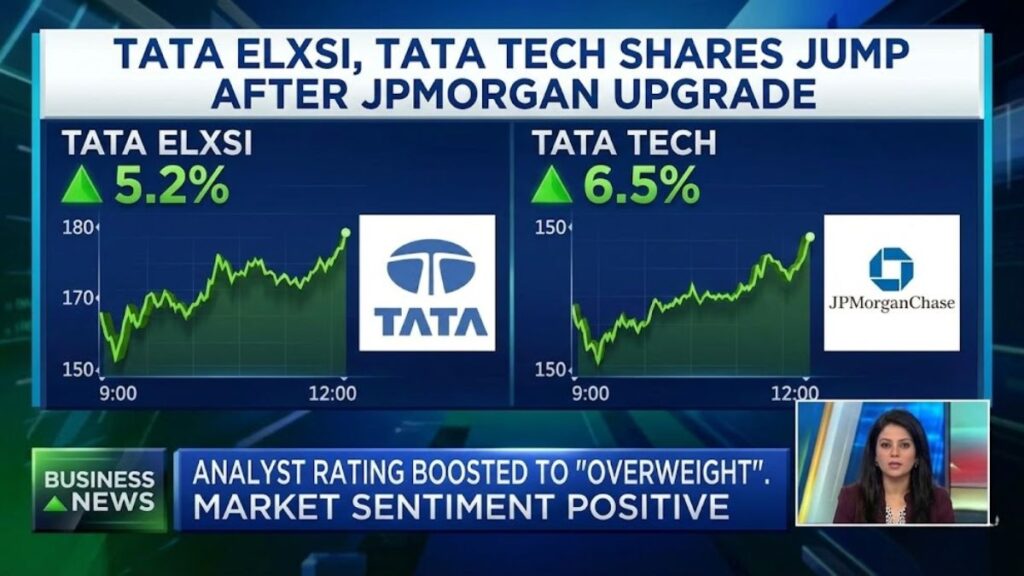

Shares of both Tata Elxsi Ltd and Tata Technologies Ltd, two Tata Group technology and engineering firms, surged sharply on the Indian stock market on Wednesday after global brokerage JPMorgan upgraded its ratings on both stocks and raised their price targets. The move triggered strong buying interest in the stocks, even as broader market indices traded with mixed sentiment.

Brokerage Upgrade Boosts Sentiment

JPMorgan revised its stance on both companies from “Underweight” to “Neutral,” reflecting a more optimistic outlook on demand trends in the automotive engineering research and development (ER&D) space. The brokerage also raised its price targets for both firms:

- Tata Elxsi: Target increased to ₹4,800 from ₹4,000.

- Tata Technologies: Target lifted to ₹710 from ₹570.

The upgrade followed indications that trade uncertainties and tariff concerns which had previously delayed global automaker R&D programs are easing, and that clients in key markets — particularly.

Europe and the Asia‑Pacific region — are resuming work and awarding new projects. This has helped lift growth expectations for engineering services firms.

Sharp Share Price Moves

The market reaction was significant:

- Tata Elxsi shares jumped up to around 10 percent intraday on Wednesday, making it one of the top gainers on the broader index.

- Tata Technologies also rallied, rising roughly 4–5 percent in trade.

Tata Elxsi’s price surge marked a strong reversal after a period of underperformance relative to broader tech indices in 2025, when it lagged peers due to weaker demand and macro uncertainty.

Why the Upgrade Matters

JPMorgan’s shift reflects an improvement in auto industry spending patterns, particularly in hybrids, connected vehicles and autonomous driving technologies. The brokerage noted that automakers had previously paused or slowed R&D programs in response to global trade disputes and other headwinds. With those concerns easing, companies like Tata Elxsi and Tata Technologies could see stronger project pipelines and revenue growth ahead.

The brokerage also raised revenue and margin estimates for Tata Elxsi for fiscal years 2026–2028 and projected earnings upgrades, suggesting that the near‑term earnings outlook has improved thanks to stronger demand and operational recovery.

Sector Context: Auto ER&D and IT Stocks

Tata Elxsi and Tata Technologies are key players in auto ER&D, connected cars and embedded software, a niche segment of the broader IT services market. Their performance often tracks cyclicality in automaker R&D spending, especially with European and North American Original Equipment Manufacturers (OEMs).

In 2025, both stocks underperformed compared with the Nifty IT index, which itself faced pressure, as auto‑focused engineering demand lagged broader digital and cloud spending. Tata Technologies declined about 28 percent and Tata Elxsi was down around 23 percent during that period, highlighting how sector‑specific dynamics influenced performance.

Valuation and Analyst Viewpoints

While the rating move to “Neutral” is a positive signal, JPMorgan’s call stops short of a full “Buy” recommendation. The valuation case for Tata Elxsi reflects modest revenue growth projections compared with some peers and a significant portion of its business tied to cyclic auto projects. Some analysts note that, despite gains, valuation premiums and growth expectations need to be balanced with the stock’s long‑term performance outlook.

Other brokerages have varied views on Tata Elxsi. For example, one recent analysis highlighted that even with price target increases from some analysts, cautious stances remain due to valuation and revenue concentration factors.

Investor Implications

For market participants, the JPMorgan upgrade has several implications:

- Positive near‑term catalyst: The upgrade has already boosted share prices and could support further interest if the auto ER&D demand narrative strengthens in earnings reports.

- Price target trends: Elevated targets from ₹4,000 to ₹4,800 for Tata Elxsi and from ₹570 to ₹710 for Tata Technologies may act as reference points for medium‑term positioning.

- Sector recovery watch: Investors will be watching auto R&D spending signals, especially contract wins and order pipelines from European and Asia‑Pacific clients, as key drivers for future performance.

Conclusion

The JPMorgan upgrade for Tata Elxsi and Tata Technologies reflects improving sentiment in the auto engineering R&D sector and has provided a strong boost to their share prices.

While the stocks now carry improved outlooks and higher price targets, investors are likely to monitor upcoming quarterly results and global demand trends closely to judge if the recovery in R&D spending sustains.