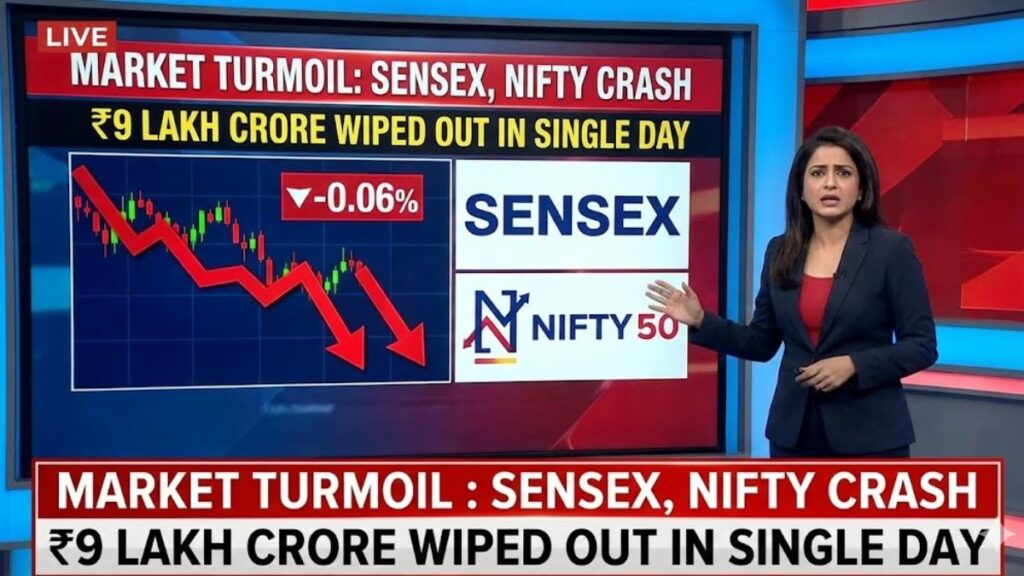

Mumbai, January 8, 2026 — In a dramatic and unsettling session on Dalal Street, India’s stock markets plunged sharply for a fourth consecutive day, erasing an estimated ₹8–9 lakh crore ($97–109 billion) of investor wealth amid a cascade of global shocks and domestic selling pressure. Benchmark indicators ended deep in the red, with heavyweights across sectors tumbling on renewed geopolitical and economic uncertainty.

What began as a cautious decline earlier in the week swiftly snowballed into one of the most pronounced stock market sell‑offs in recent months, leaving traders, fund managers and retail investors scrambling for cover. Despite fleeting attempts at recovery mid‑session, market breadth remained overwhelmingly weak.

A Market Friday With a Storyline

The BSE Sensex plunged by nearly 780 points, while the NSE Nifty 50 slid below the 25,900 level, confirming broad downside momentum in both headline indices. Midcap and smallcap stocks, often seen as risk barometers, were hit particularly hard, reflecting fear‑driven repositioning by investors.

While the exact photo gallery from the CNBC‑TV18 report could not be accessed, multiple market trackers confirmed the extent of the sell‑off and the cumulative hit to market capitalisation. Analysts describe the session as one of the worst in four months, with volatility spiking across segments.

Global Shockwaves Amplify Domestic Pain

The broader sell‑off did not occur in isolation. Global cues have rattled markets across continents in recent days:

- Tariff fears and trade tensions emanating from the United States unsettled global equities, lifting volatility and pressuring emerging markets like India’s.

- Subdued or mixed corporate earnings reports added to the damage, weakening risk appetite among domestic participants.

- Long‑standing geopolitical concerns, from energy security worries to political instability in key regions, continued to hang over markets like a dark cloud.

This confluence of factors created a volatility crucible, layering technical selling on top of fundamental unease and driving broad‑based declines.

Heavyweights Take the Hit

Major industrial and financial stocks led the sell‑off, dragging headline indices lower as institutional traders reduced exposure. Banking sector names, oil & gas majors, and metal players showed particularly weak momentum, while only a few pockets of outperformance could be found among defensive or undervalued names.

The broader Nifty midcap and smallcap indices also reflected risk‑off sentiment, with steeper declines compared with large caps, intensifying pressure on leveraged and retail traders who had been seeking alpha outside traditional blue‑chip stocks.

Investors Wrestle With Uncertainty

A central theme of the sell‑off was uncertainty and fear, rather than one clear catalyst. Traders cited:

- Renewed fears of trade policy shifts, especially U.S. tariff pressures that could ripple into global supply chains.

- Global market weakness, including major overseas indices, which spill over into emerging markets like India.

- Mixed economic signals from corporate performance and macro data, which dissuaded fresh buying.

In such environments, even routine profit‑taking can trigger outsized moves, as algorithmic trading and stop losses amplify downward trends.

Technical Stress Points Trigger Further Selling

Beyond fundamentals, technical factors may have worsened the slide:

- Multiple support levels for key indexes were breached, prompting algorithmic and discretionary selling.

- Volatility indices spiked, reflecting increased hedging activity and risk aversion.

- Historic highs in some segments earlier in 2025 meant any downturn risked triggering psychological sell thresholds.

Institutional desks noted that pre‑set risk parameters may have forced additional sell orders, especially in funds with strict drawdown limits.

Retail Investors Felt the Sting

For individual investors, the market rout translated into visible portfolio erosion.

Retail trading platforms reported heightened activity as novice traders faced steep mark‑to‑market losses on leveraged positions. Some brokers advised cautious rebalancing, urging clients not to panic sell but to evaluate long‑term fundamentals.

Even seasoned investors, typically less rattled by short‑term volatility, described the suddenness of the slide as “unsettling” and “capricious,” highlighting the difficulty of navigating markets in a high‑uncertainty macro backdrop.

Is This Just a Correction or Something More?

Market analysts are divided on whether the downturn signals a broader bear phase or simply a steep correction:

Scenario 1: Short‑Term Shock

Some strategists argue that the current sell‑off reflects a temporary repricing due to global risks and tariff uncertainties. In this view, once clarity emerges on key economic policies, markets could stabilise and even rebound.

Scenario 2: Structural Weakness

Other analysts warn that persistent foreign portfolio investor exits and tightening financial conditions could underpin a deeper correction, potentially lasting several weeks. Previous bouts of volatility in 2025 already saw notable wealth erosion across sectors.

Investors are watching key economic indicators and upcoming corporate earnings cycles for signs of direction.

A Market With a Memory of Crashes Past

While today’s drop is severe, it echoes earlier periods of sharp market stress, including episodes where billions were wiped out in a single session or over a short span. India’s markets have encountered dramatic swings before, from tariff shock‑linked sell‑offs to geopolitical sell pressure and policy‑driven reversals.

History shows that such episodes tend to reshape investor strategies, sometimes leading to regulatory tightening and updated risk frameworks to prevent systemic shock.

What Traders Are Watching Next

In the hours and days ahead, market participants will likely focus on:

- Follow‑up government or central bank statements, especially from the Reserve Bank of India or major global central banks.

- US trade policy developments, particularly any official tariff announcements that could affect global trade dynamics.

- Upcoming earnings releases, which may either validate current pessimism or reveal pockets of resilience.

In addition, technical analysts will monitor support and resistance levels around key index marks that could serve as turning points.

Conclusion

The dramatic market slide that erased around ₹8–9 lakh crore in wealth this week stands as a reminder of how interconnected today’s financial systems are and how swiftly sentiment can shift. With global tensions, corporate earnings uncertainty, and persistent macro risks all converging, Indian markets face a challenging landscape in early 2026.

Whether this decline becomes a strategic buying opportunity or a protracted downturn will depend on how external risks and domestic fundamentals evolve in the coming weeks. For now, investors and traders alike are bracing for more volatility as they seek clarity in a turbulent market.