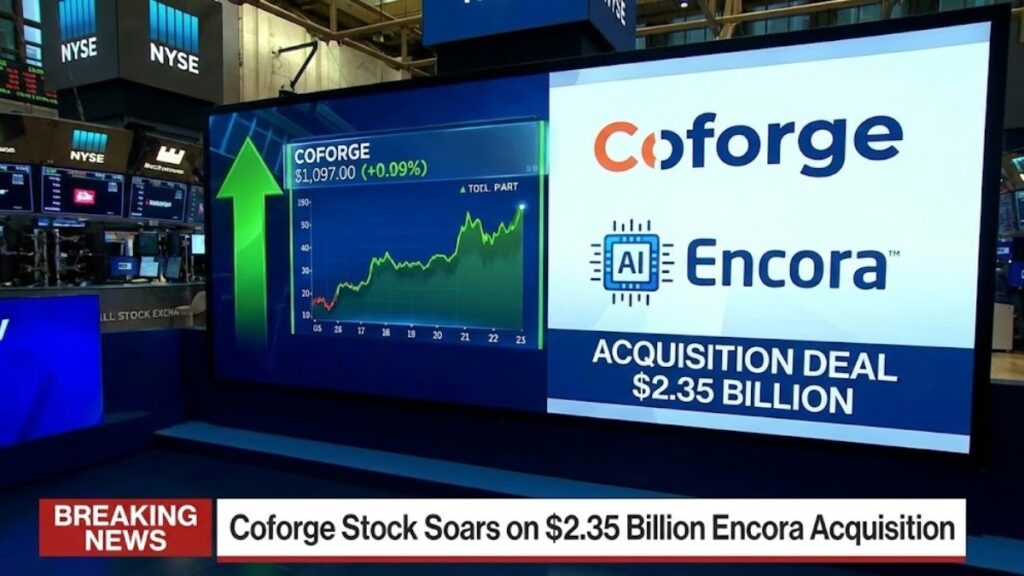

Mumbai/Noida, December 29, 2025 — Shares of Coforge Ltd., the Indian IT services company listed on the NSE and BSE, jumped over 2 percent on Monday after the firm announced its plan to acquire AI and digital engineering services provider Encora in a $2.35 billion all-stock deal, reinforcing its position in the rapidly growing artificial intelligence and cloud transformation market.

The acquisition is shaping up as one of the largest M&A deals by an Indian IT services company in the AI space, and investors have responded positively as markets opened on Monday. Shares of Coforge touched an intraday high after the announcement before settling with gains of around 2 percent.

What the Deal Entails

Under the terms of the agreement, Coforge will acquire 100 percent of Encora’s shares from private equity backers such as Advent International, Warburg Pincus and other minority shareholders at an enterprise value of $2.35 billion.

The transaction will be financed primarily via an all-stock transaction, with Coforge issuing preference shares worth approximately $1.89 billion at a premium to existing shareholders. Upon completion, Encora’s investors will own around 20 percent stake in the expanded Coforge.

The company also plans to raise up to $550 million through a bridge loan or qualified institutional placement to retire Encora’s existing debt as part of the acquisition cleanup process.

According to filings and investor presentations, the deal is expected to be EPS (earnings per share) accretive by fiscal 2027, allowing Coforge to scale its AI offerings more quickly than through organic growth alone.

Strategic Rationale: Rapid Expansion in AI and Digital Engineering

Coforge executives highlighted that this acquisition will help the company build a “scaled, AI-led engineering capability moat” — essentially a sustained competitive advantage in advanced technology services such as artificial intelligence, data engineering, and cloud-native development.

Encora, founded in 2005 and headquartered in the United States, specialises in AI-native engineering services, offering solutions for product development, cloud computing, data strategy, and intelligent applications. The firm reported revenues of more than $500 million in fiscal 2025, with continued momentum expected into fiscal 2026. coforge.com

Industry analysts have pointed out that this acquisition significantly strengthens Coforge’s North America footprint, especially in the US West and Midwest regions, while also adding about 3,100 skilled employees in Latin America — a region increasingly important for near-shore delivery models.

Market Reaction and Analyst Views

Investor response has been upbeat. On December 29, 2025, Coforge shares were trading higher in early deals, with market watchers picking the stock as one to watch among IT services plays.

Brokerages have offered differing interpretations of the acquisition’s impact on future returns:

- Macquarie upgraded its rating on Coforge to “Outperform” from “Underperform”, lifting its target price significantly.

- Motilal Oswal maintained a bullish view, setting a higher target price around ₹2,500.

- Emkay Global recommended an “Add” stance with a target near ₹2,000.

- Conversely, Elara Capital suggested a “Reduce” rating with a more conservative target of ₹1,720, expecting less upside from the deal at current levels.

These varied stances reflect broader debate over how quickly the acquisition will translate into revenue growth and margin enhancement for Coforge. Analysts emphasise that while the transaction adds scale and AI capability, integrating two distinct corporate cultures and systems remains critical to realising expected synergies.

Industry Implications: The AI Race in IT Services

Coforge’s move underscores a broader trend in the IT sector: traditional service providers are doubling down on digital transformation and AI capabilities to stay competitive.

With AI increasingly reshaping enterprise software, cloud services, and data analytics, IT firms are emphasising inorganic growth — including mergers and acquisitions — to accelerate their capabilities rather than building them from scratch.

Other examples in the tech services domain include major global players expanding through strategic acquisitions focused on cloud computing, cybersecurity, and full-stack development services.

For Coforge, the Encora acquisition is expected to help the firm compete more effectively with larger Indian IT majors while also narrowing the gap with specialised digital transformation consultancies. It also provides a fuller suite of services across AI, data, and cloud engineering.

Financial Scale and Future Outlook

Before this deal, Coforge reported revenue of approximately ₹120.51 billion (about $1.34 billion) in fiscal 2025, marking roughly 32 percent year-on-year growth, while Encora’s turnover stood at about $516 million for the same period. Combined, analysts estimate the firm could be operating in the range of $2 billion–$2.5 billion in annual revenue by fiscal 2027.

The combined entity’s operating margin is projected at around 14 percent before interest and taxes, a figure that industry strategists say is competitive for AI and engineering services firms of comparable size.

Coforge’s CEO has been clear that the goal is not just scale but depth — building out capabilities in enterprise data platforms, cloud infrastructure, and AI-powered engineering solutions that clients increasingly demand. With Encora’s client base and Coforge’s existing global delivery network, the combined firm aims to serve larger enterprise accounts with integrated offerings.

Deal Timeline and Next Steps

Coforge has indicated that the acquisition is expected to be completed within four to six months, subject to regulatory approvals and customary closing conditions. Once the deal closes, Encora’s operations will be integrated into Coforge’s global services portfolio.

Shareholders and investors will be closely monitoring developments, including how quickly new revenue streams from AI and advanced engineering services contribute to quarterly results and how the combined workforce adapts to the enlarged organisational structure.

Summary

Coforge Ltd. saw its shares lift more than 2 percent on December 29, 2025, following its announcement of a $2.35 billion all-stock acquisition of U.S.-based AI engineering firm Encora. The deal is positioned as a strategic move to enhance Coforge’s AI, cloud, and data capabilities while expanding its geographic footprint, particularly in North and Latin America.

Analysts have responded with mostly positive outlooks, although views vary on valuation and earnings impact. The integration of Encora is expected to close by mid-2026, potentially creating a combined IT services firm with revenues in excess of $2 billion and a stronger competitive edge in AI-driven solutions.