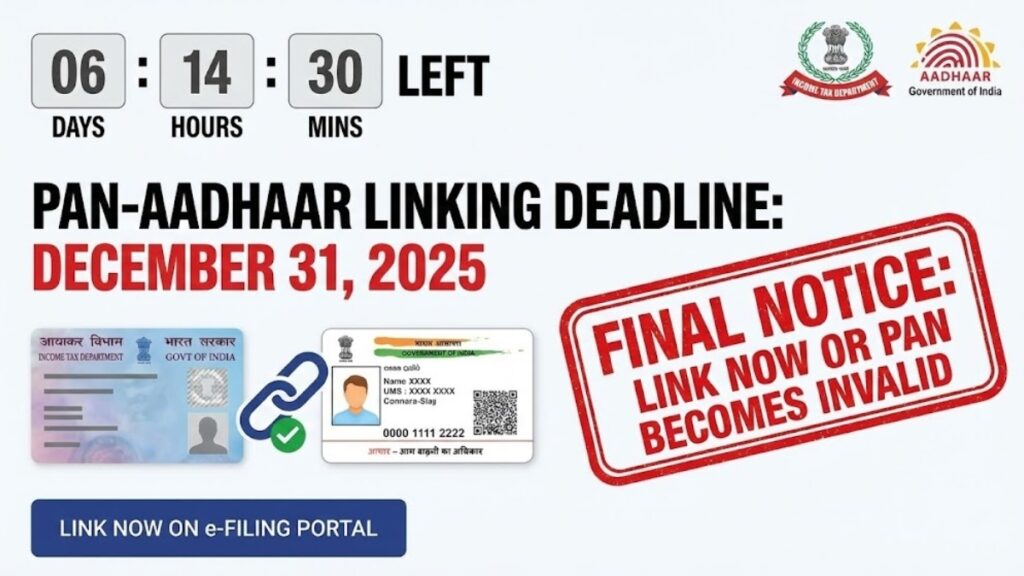

As the year draws to a close, taxpayers across India are being urged to link their PAN (Permanent Account Number) with Aadhaar before the final deadline of December 31, 2025. Failure to complete the process on time will result in the PAN card becoming inoperative from January 1, 2026, potentially disrupting tax filings, financial transactions, refunds, and compliance with key financial regulations. With only days remaining, experts warn of significant consequences for non-compliance and recommend immediate action.

What Is the PAN-Aadhaar Linking Requirement?

The Government of India, through the Central Board of Direct Taxes (CBDT), made PAN-Aadhaar linkage mandatory for eligible taxpayers to curb tax evasion, eliminate duplicate PAN cards, and strengthen the tax system. Individuals whose PAN was issued using an Aadhaar enrolment ID before October 1, 2024 must now formally link their PAN to their permanent Aadhaar number by December 31, 2025.

This requirement is enforced under the provisions of the Income Tax Act, and although earlier deadlines for Aadhaar-PAN linking existed, the latest notification specifically extends the timeline for this group of taxpayers whose PANs were generated via Aadhaar enrolment IDs.

Why the Deadline Matters

From January 1, 2026, PAN cards that remain unlinked to Aadhaar will be declared inoperative, meaning they will no longer be treated as valid for many financial and tax-related activities. An inoperative PAN can lead to severe consequences:

- Income Tax Returns (ITR) cannot be filed or verified, and pending refunds could be blocked.

- Higher tax deductions at source (TDS) and tax collection at source (TCS) rates may apply, affecting take-home income.

- TDS credits may not reflect correctly in Form 26AS, complicating annual income tracking.

- New bank accounts, investments, or financial services requiring PAN-based KYC verification may be restricted.

- Mutual funds, stock brokers, and other financial service providers may suspend services if PAN is inoperative.

The operational disruptions extend beyond taxation, affecting everyday financial activities and compliance requirements for individuals and businesses alike.

Who Must Link PAN with Aadhaar

Not every PAN cardholder is subject to this specific deadline. The requirement applies particularly to individuals whose PAN was allotted based on an Aadhaar enrolment ID before October 1, 2024 and who now have a permanent Aadhaar number issued. For most other taxpayers, linking should have been done under earlier mandates, and they may already be compliant.

Under the Income Tax Act, all eligible Indian citizens who have both PAN and Aadhaar are expected to complete this linking, although certain categories remain exempt, such as:

- Residents of Assam, Jammu and Kashmir, and Meghalaya (due to UIDAI licensing issues).

- Non-resident Indians (NRIs).

- Individuals 80 years and older.

However, even exempt individuals are encouraged to link for simplified compliance and to avoid complications during financial transactions.

A Step-by-Step Guide to Linking PAN and Aadhaar

With the deadline imminent, taxpayers should know exactly how to complete the linking process. Fortunately, authorities have made it straightforward and accessible through both online and offline methods.

Online Method

- Visit the Income Tax e-Filing portal at incometax.gov.in.

- Under “Quick Links,” select Link Aadhaar.

- Enter your PAN, Aadhaar number, and name as per Aadhaar records.

- Verify using the OTP sent to your Aadhaar-linked mobile number.

- If linking is done after the original deadlines, a late penalty of ₹1,000 may be payable through the e-Pay Tax portal.

- Submit the form and check the status later on the portal to ensure successful linkage.

Offline Methods

Taxpayers who face challenges online can also link PAN with Aadhaar through other channels:

- SMS: Send a specific SMS format (e.g., “UIDPAN <12-digit Aadhaar> <10-digit PAN>”) to service shortcodes provided by tax authorities.

- Service Centres: Visit an authorised Protean or UTIITSL PAN Service Centre with original and self-attested copies of PAN and Aadhaar for assistance.

These alternative routes ensure that even taxpayers without immediate online access can meet the deadline.

Common Linking Issues and How to Fix Them

Despite a straightforward process, many taxpayers encounter obstacles while attempting to link PAN with Aadhaar — especially when details do not match. Expert guidance suggests the following solutions before December 31:

Mismatch of Names or Dates

If your name, date of birth, or gender details differ between PAN and Aadhaar records, the system may reject your linking request. In such cases:

- Update your Aadhaar details first through the UIDAI portal or enrolment centre.

- Once Aadhaar details are corrected, attempt the PAN-Aadhaar link again.

Incorrect Mobile Number

Your mobile number must be linked with Aadhaar to receive OTP verification. If it isn’t:

- Update the number through UIDAI before attempting PAN-Aadhaar linkage.

Taking care of these issues well before the deadline can prevent last-minute frustration and ensure compliance.

Penalties and Charges for Late Linking

While the current extended deadline applies mainly to specific PAN holders, linking PAN after earlier deadlines may attract a late fee of ₹1,000 under the Income Tax Act.

This charge applies when the linking is done after prescribed due dates but before the final cut-off. However, linking your PAN with Aadhaar on time now — before December 31 — can help avoid additional fees or complications linked to reactivation of an inoperative PAN.

What Happens After December 31, 2025?

From January 1, 2026, PAN cards that have not been linked to Aadhaar will be marked inoperative. An inoperative PAN can still be reactivated later, but this requires additional steps, including payment of the late fee, and may take several days — hindering financial plans and compliance activities.

Meanwhile, financial service providers and government agencies will enforce compliance more strictly, so having an operative PAN is essential for routine financial activities, taxation, investment, credit applications, and regulatory compliance.

Public Response and Concerns

Public feedback on this deadline has been mixed. Many taxpayers express concern about technical challenges or lack of awareness about the extended timeline, prompting advisory campaigns from tax professionals and financial planners.

Financial experts are urging citizens not to delay, highlighting that even minor discrepancies in personal details can cause linkage failure, and correcting them takes time. Given the short window remaining, awareness campaigns emphasise early action rather than waiting until the last minute.

Final Takeaways: Act Now or Face Consequences

With less than ten days left before the PAN-Aadhaar linking deadline, taxpayers must prioritise completing this compliance requirement to prevent disruption in financial and tax-related services.

Here’s a quick checklist:

- Check your PAN-Aadhaar linking status online immediately.

- Update any mismatched details in PAN or Aadhaar to ensure seamless linking.

- Link PAN with Aadhaar via online or offline methods before December 31, 2025.

- Prepare to pay the penalty if linking after previous deadlines..

Failing to act now could lead to frozen tax refunds, blocked banking services, higher TDS, and restricted financial transactions come January 1, 2026.

Tax authorities urge citizens to take these final days seriously and complete the process early, avoiding last-minute stress and technical issues as the year ends.